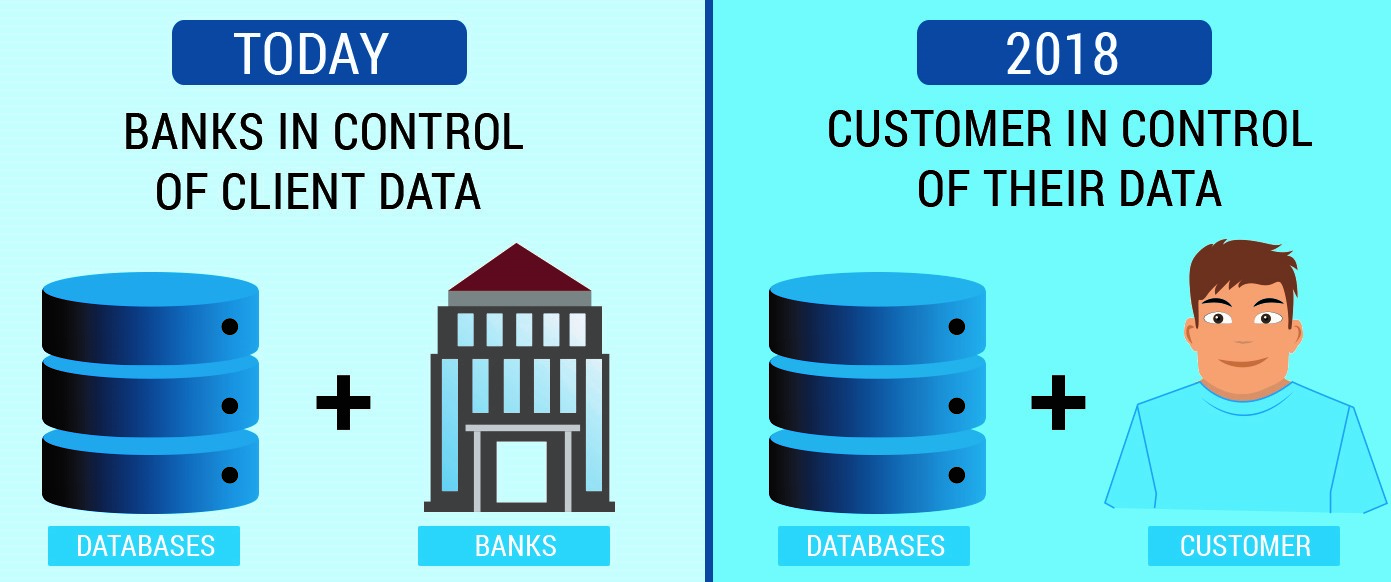

2018 is likely to be a game-changing year for the banking and finance sector. As the General Data Protection Regulation (GDPR) and Revised Payment Service Directive (PSD2) are implemented across the European Union, the exclusive control of banks and other financial institutions on financial data of their customers is about to end. These new regulations will open the door to almost any company interested in claiming a share, particularly the tech giants, such as Amazon, Facebook, Google.

While this may look like a challenge to many, we, as journey science experts, view this as an opportunity for banks to partner with large tech, eCommerce, and fintech enterprises and leverage their expertise at managing customer experiences to revolutionize customer journeys and offer an improved, more holistic experience to their end-users.

In this article, we have reviewed how implementation of PSD2 and GDPR will transform the banking and finance industry and result in a new wave of partnerships between banks and ecosystem enterprises to create a win-win situation for everyone, including customers, financial institutions, major tech players, such as Google, Amazon, Facebook, eCommerce companies, as well as small fintech start-ups.

How Upcoming Regulations Will Revolutionize the Banking Industry?

The new regulations will introduce banks to two new competitive forces — PISP and AISP. PISP or Payment Initiation Service Providers are the merchants who will able to access customers’ accounts. This will allow customers to choose third-party providers to initiate their transactions. Consequently, customers will be able to use Facebook to pay their bills or Google to make a wire transfer.

The second type of competitive force, AISP (Account Information Service Provider) are the third-party providers that will aggregate the financial data of customers with more than one bank account to offer a more integrated and improved experience to the users. They will capture all the account information in one place for customers, offering them a more cohesive experience — similar to the services offered by Mint in the US.

Depending on the adoption rate, there are two possible scenarios that may result from the implementation of the upcoming regulations.

- Slow Adoption —The slow adoption of the new solutions by customers due to lack of interest will provide banks the time they need to create improved solutions using their legacy systems. However, because of their relatively limited expertise and knowledge of customer journey as compared to large tech, eCommerce, and fintech enterprises, banks may not face challenges experiencing the true potential of this opportunity.

- Fast Adoption — In this scenario, tech companies, particularly Google, Facebook, and Amazon, will be able to use their robust, future-proof infrastructure to create new solutions and improve customer experience substantially. A mutually beneficial partnership between banks and these tech companies constitutes the ideal scenario as this will provide an opportunity to analyze and draw insights from the large amounts of data available to banks. This, consequently, will improve customer journey, benefiting everyone involved in the process, including customers, banks, and tech enterprises.

An Ecosystems Approach — A Golden Opportunity for Banks

Banks cannot afford to ignore the long-term implications of the upcoming regulations, particularly PSD2 and GDPR, if they intend to stay competitive and ahead of the game. Financial institutions should begin with a thorough assessment of their operational models, particularly their customer journey, and embrace technology to build solutions that can ensure them success in the next-generation banking landscape.

While the implementation of PSD2 and GDRP may look like a challenge to banks, it is indeed an opportunity to grow new revenue streams by progressing towards an extended ecosystem — an ecosystem that drives value and fosters customer loyalty by allowing users to acquire information and conduct transactions in a ubiquitous manner. This ecosystem consists of three major players:

- Tech giants, such as Facebook, Google and Amazon

- Fintech companies

- eCommerce/Retail Companies

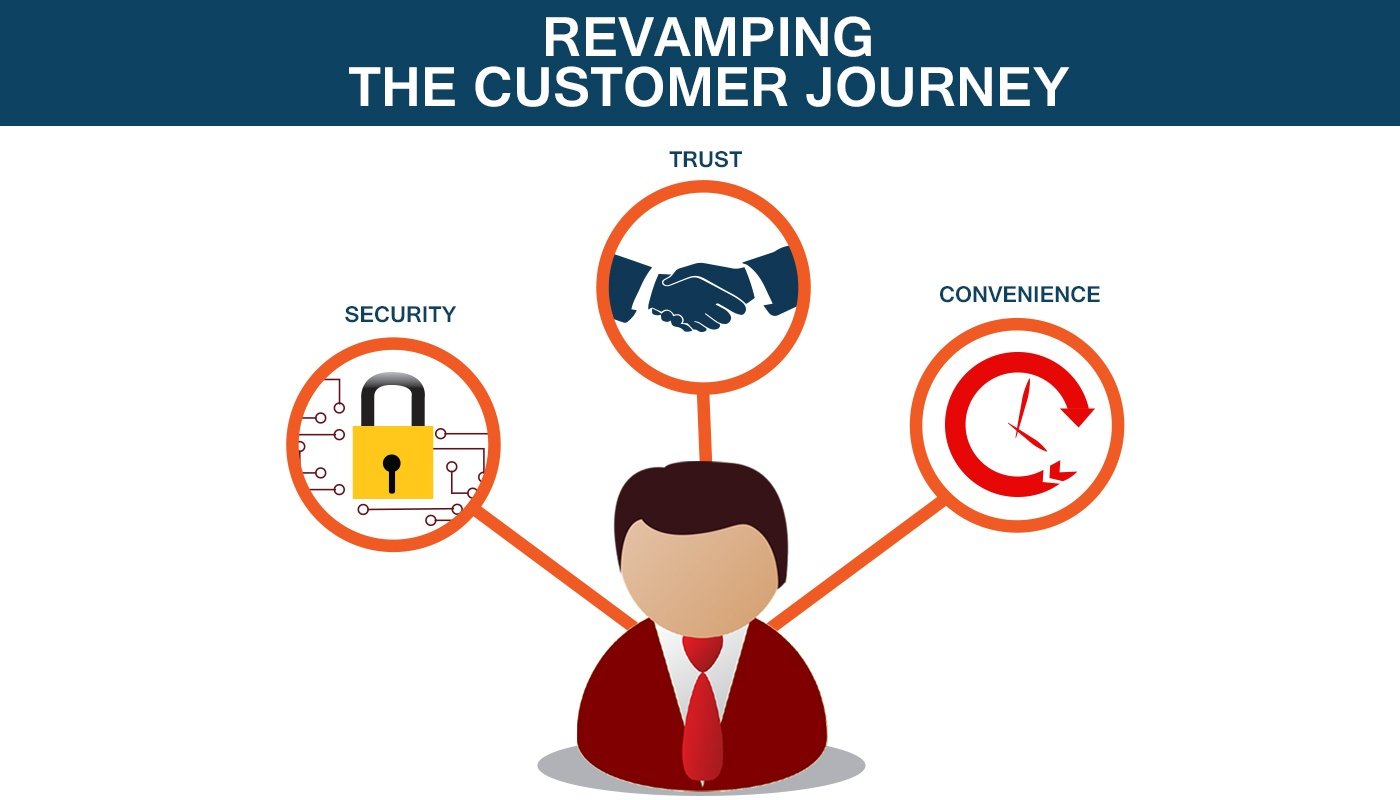

Revamping the Customer Journey

Today’s well-informed customer demands superior-quality services from providers. They seek to work with brands that offer them just what they want, and when it comes to banking and financial services, trust, convenience, and security are the three primary concerns of customers. Therefore, adapting to the new regulatory requirement and finding success in a more complex industry landscape is all about giving customers choice. Only those institutions that are technically able and culturally willing to build new, improved customer experiences will be able to survive and thrive in the competitive landscape of the banking industry.

In order to stay relevant and competitive, banks must offer customers what they desire, and to ensure this they will be required to thoroughly study their customer journey. While banks have immense amounts of data available at their hands, their limited experience in journey science could potentially hold them from unleashing the true potential of a superior-quality customer experience. Perhaps the only and the most viable way banks can overcome this issue is by working in collaboration with the likes of Google, Facebook, Amazon, fintech and eCommerce companies.

The partnership of financial institutions with these companies offers exceptional possibilities to improve customers’ satisfaction by offering them a more convenient and value-adding experience. Here are a couple of examples.

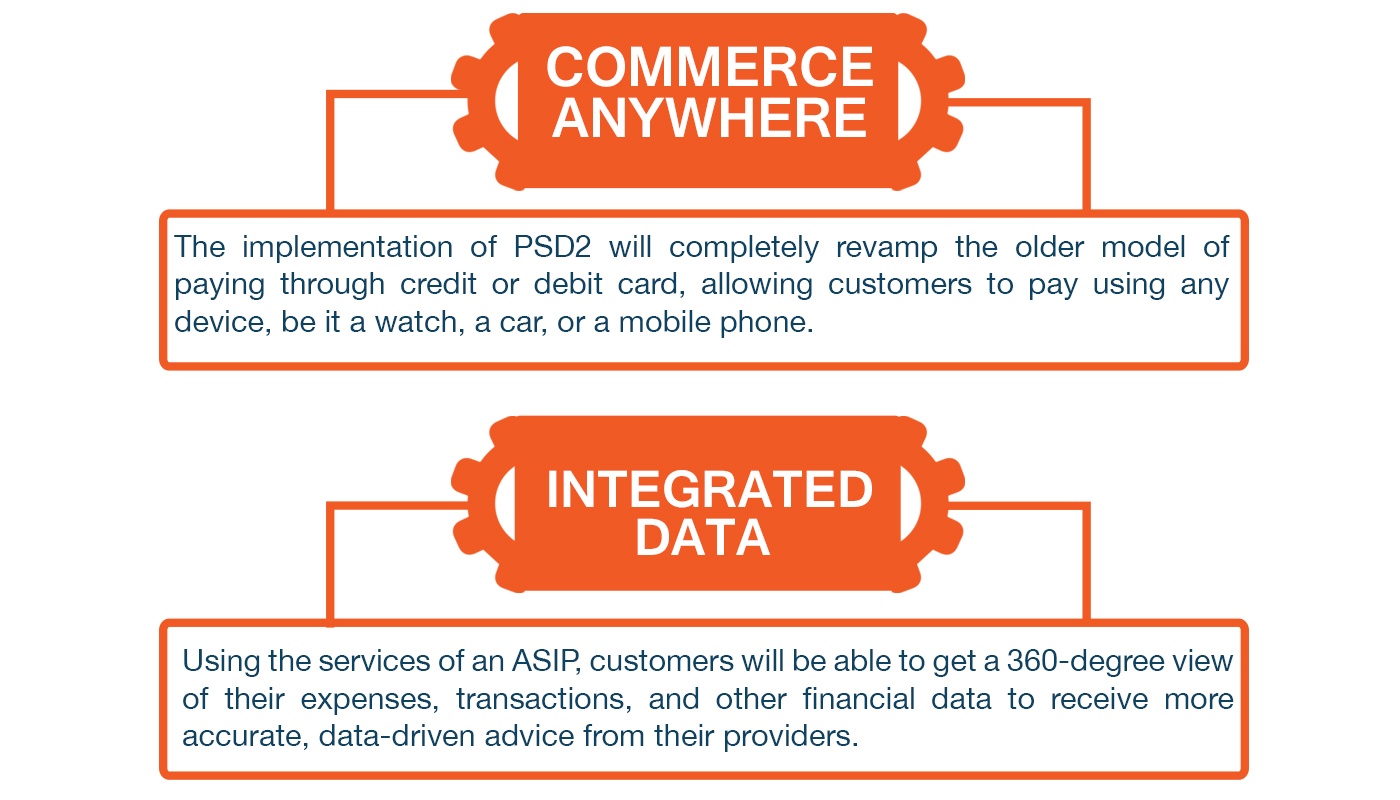

- Commerce Anywhere — Traditionally, when purchasing something from a brick and mortar store, customers are required to get into a queue and pay using their credit or debit card. The implementation of PSD2 will completely revamp this model, allowing customers to pay using any device, be it a watch, a car, or a mobile phone.

- Integrated Data — Using the services of an ASIP, customers will be able to get a 360-degree view of their expenses, transactions, and other financial data to receive more accurate, data-driven advice from their providers.

While these futuristic payment technologies offer great value to the customers, the role of banks in the payment chain remains questionable. Here are a few possible ways through which banks can embrace opportunities of this extended customer journey and stay competitive include:

- API Economy — To offer an improved experience to customers, banks should look for ways to deliver their core services to the customers at the right place and time. Visa has already taken revolutionary steps in this regard and allows its customers to make payments from any IoT connected device.

- Best of Breed Customer Experiences — To stay relevant and competitive against the emerging players, banks are required to extend the scope of their offerings and act as a distributor of financial products that their customers prefer. To ensure this, banks will be required to form new partnerships with businesses that can help them create a diverse range of customer journeys.

Using Data-Driven Customer Journey Insights to Fuel Success

While banks and other financial institutions use data obtained from customers’ interaction with the brand to offer improved services, the scope of this practice is limited to their internal landscape only. The upcoming regulatory changes extend customer journey to include several third-party providers as well. Therefore, in addition to data captured at touch points within their own organization, banks need to focus on customers’ interaction with companies outside their ecosystem and use the information to improve their customer experience.

A partnership with Google, Facebook, Amazon, and other companies that excel at user behavior and customer journey analysis will offer banks an access to top-of-the-line data analytics technologies, allowing them to extract valuable insights from the customer journey and use them to offer personalized services to their customers.

Upgrading the Capabilities to Transform Customer Journey Data in Real Time

The implementation of GDPR and PSD2 poses two major challenges to banks — the need to stay competitive by offering customers a premium-quality experience and avoid the penalties and sanctions associated with non-compliance. The stringent regulatory requirement of tomorrow demands that businesses build their capability to manage rejections and consents, adopt optimal data governance practices, measure and transform customer journey data into relevant experiences and future-proof their legacy systems and applications to avoid penalties.

How Progressive-Thinking Financial Institutions Are Responding to the Situation?

The speed and complexity of change experienced by the banking and finance industry is incredible and can only be managed by those who use technology and focus their resources at revamping their customer journey. As a result, progress-thinking, growth-oriented financial institutions have already established partnerships with companies that hold in-depth knowledge of journey science and have a proven track record of creating superior-quality customer experiences.

Conclusion

PSD2 and GDPR will revolutionize the banking industry. The leading banks of the future will be those that remain successful at crafting a strategic response to these technological and regulatory disruptions.

While there is no universal solution to overcome this multi-dimensional ‘power to the people’ opportunity, establishing trusted, value-adding relationships with companies like Google, Facebook, Amazon, eCommerce companies as well as fintech start-ups should be the primary focus of banks. This will help banks gain insights into customer behavior, drive more value by establishing an extended customer journey, and boost customer experience.

The upcoming regulatory changes are extending customer journeys beyond the organizational boundaries and to manage this exponential complexity, banks need to build competencies around Journey Science and invest in scalable infrastructure to support their agile journey science teams.

Special thanks to Ronald van Loon for co-authoring this post.