We soon might experience a surprising, and to many a contradictory, move by banks. The more Big Tech is failing to recover trust, the bigger the chance banks will fill this gap.

As Facebook’s Libra plans have left many in doubt, from politicians to professionals and from regulators to consumers, and since nearly every Big Tech encountered numerous data and other reputational issues, Big Techs starting to offer financial products and services is not a sunny perspective to many. Due to the Cambridge Analytica scandal, Google’s sexual misconduct case, the US election and many other cases, Big Techs are quickly losing trust. And trust is probably the most important asset you need when you enter the financial industry.

A Grail Insights survey of 1,069 consumers revealed that two-thirds of Americans think large companies have too much control over their personal data, while 75% say those companies aren’t doing enough to protect their data and privacy.

Banks know how important trust is. It has been the cornerstone of their business model for decades. And yes, reputation and trust in banks has declined massively since 2008, but banks still yield more trust than tech companies, reports show. And looking at the latest Big Tech scandals, they are not on the winning hand in the ‘competition of trust’. But it’s not an easy win for banks either. They need to work hard and might need some help, too.

Restoring trust as an opportunity

Whatever happens, the opportunity for banks lies in restoring trust. And that’s something they can control, unlike, for example, regulation. Trust is a key driver in customer loyalty and for new generations probably even more so. Trust is, until 2008 at least, where banks have always scored best. And with the right approach, banks will be able to restore this and remain the place to go for your money matters.

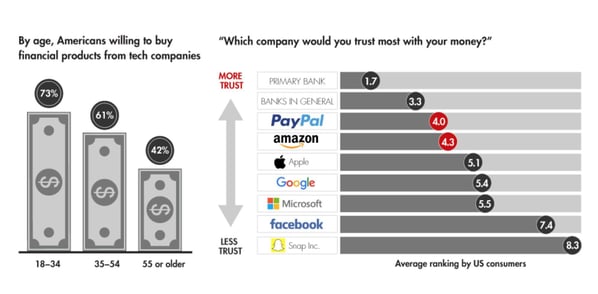

In below image, the graph on the right shows that by far most people trust their primary bank and banks in general more with their money than tech firms.

Source: Bain/Research Now Customer Loyalty in Retail Banking Survey, 2017

This image is about US banks. On other continents it might look somewhat different, but the trend is the same. Banks should put much more consistent efforts in restoring trust or at least make sure they maintain this competitive edge. That way, they will win the battle for the customer. And that’s the only thing that counts.

This image is about US banks. On other continents it might look somewhat different, but the trend is the same. Banks should put much more consistent efforts in restoring trust or at least make sure they maintain this competitive edge. That way, they will win the battle for the customer. And that’s the only thing that counts.Communicate communicate communicate

What should banks do? Go back to where they came from, but with a humble and fully open mindset and attitude. Truly put customers at the center of everything the bank does and make sure your purpose is communicated in a crystal clear way, so people can connect to it. (If your business has not been built on a purpose, you better stop it.) The secret recipe is: communicate communicate communicate. This is a domain in which financials have been performing really poorly over the past decades. Be open and honest about what you stand for and do and talk about this in a consistent way. Ultimately, purpose-driven and client-centric companies who tell an authentic story, win.

This is not some sort of hollow phrase, it simply means three things:

-

Do what you stand for

-

Truly PUT the customer first (don’t just say you do it)

-

Open up

Whether you are developing a new product or service or whether you’re giving a talk on stage or write a blog like this one: repeat your purpose and message, over and over. Because the clearer this is communicated, the more of a no-brainer it becomes for clients to trust you, connect to it and hop on board. And then, loyalty will follow suit.

At the same time, Big Techs’ business models are built on scale and gathering data. So, although they already encounter massive reputational setbacks in this area, I don’t see them move away from it so easily. Of course, they learn, but are they willing to transform their models? I don’t think so. And regulation on this front probably won’t be their best friend. The declining lack of trust in Big Techs is an opportunity for banks.

Are banks going to collaborate with Big Tech maybe?

Think 5 years ahead. As the big platforms (GAFA and others) have continued to grow and mid-sized regional platforms have been gaining ground as well, it might very well be that these tech companies have realised that financial services are a way to build loyalty, but that they are not the ones to lead this practice. This is exactly where the opportunity for banks might be. They need to find a way to partner with Big Techs however, because Big Techs have the data and customer intimacy. And the banks then might have the trust…. It will be very interesting to see how that model will look like in the future.

But before they can compete, the first step for financial institutions is: revitalizing trust, in order to move forward and stay a relevant market player in the first place. And revitalizing that trust is not a matter of regulation or anything in the outside world. It is primarily in their own hands.